Hire Frappe Lending App Developers

At Bizupsol, we specialize in building and customizing lending solutions on the powerful Frappe framework.

Contact us for a free platform demo

ERPNext Loan & Lending Module Customization Company

Engineer a Modern, Automated, and Secure Lending Platform

Managing the entire loan lifecycle---from application and underwriting to disbursement and collections---is a complex process that demands precision, security, and efficiency. Traditional methods involving manual paperwork and disconnected spreadsheets are slow, prone to errors, and cannot scale with your business. To succeed in today's financial landscape, you need a centralized Loan Management System that automates workflows, provides real-time data, and integrates directly with your core financial accounts. The Frappe Lending platform offers this exact capability.

Leading ERPNext Loan & Lending Module Customization Company

As a leading ERPNext Loan & Lending Module Customization Company, we provide the deep technical and financial domain expertise required to build a platform that fits your specific business model. We develop solutions that automate tedious tasks, improve decision-making with data, and deliver a superior experience for both your staff and your borrowers.

Expert Frappe Lending developers

100% Open Source Loan Software

Complete Loan Lifecycle Management

Native ERPNext Accounting Integration

Secure and compliant solutions

Automated EMI & Repayment Scheduling

Scalable for any lending business

Hire Dedicated Frappe Lending App Developers & Consultants

For financial institutions and fintech companies requiring specialized, ongoing development resources, our dedicated hiring models offer flexibility and deep expertise.

Hire Frappe Lending App Developers

When your project requires in-depth customization or the development of unique features, you can Hire Frappe Lending App Developers from our team. You get a dedicated developer who understands both the Frappe framework and the nuances of financial software development. They work as an integrated part of your team, focused solely on building and enhancing your lending platform.

Your Frappe Lending Platform Consultant

A successful lending platform requires a solid strategic and technical blueprint. Our Frappe Lending Platform Consultant service provides you with a senior expert to guide the planning and design of your system. They will help you define your loan products, map out your operational workflows, design your risk models, and create a detailed project roadmap, ensuring your technology investment is aligned with your business goals from day one.

Hire Dedicated Lending Development Team

Bizupsol: Your Top Frappe Lending Module Development Company

The success of a financial technology project depends on a partner who understands both the software and the industry's regulatory and operational demands. Bizupsol is a specialized development firm with a proven track record in building secure and compliant financial applications on the Frappe framework. Our team consists of developers who are not only Frappe experts but also possess a strong understanding of financial processes, making us the ideal partner for your ERPNext Loan Management System Development.

We approach every project as a long-term partnership. We work diligently to understand your business model, risk management policies, and compliance requirements. This allows us to deliver a customized Frappe Lending solution that is not just technologically sound but also fully aligned with your business objectives. Our commitment is to provide a platform that reduces your operational friction, minimizes risk, and supports your growth.

Deep Technical and Financial Expertise

Our developers are experts in the Frappe framework with specialized knowledge in financial software development. We understand loan workflows, interest calculations, and regulatory compliance requirements.

Complete Ownership with Open Source

We build solutions on 100% open-source technology, giving you complete control and freedom from vendor lock-in. You own your platform and can modify it as your business evolves.

Transparent Communication and Project Management

We believe in building long-term partnerships based on trust. You will have a dedicated project manager and direct communication channels with our team. We provide regular progress updates and maintain complete transparency throughout the project lifecycle.

Focus on Security and Compliance

We prioritize data security and regulatory compliance in every solution we build. Our platforms are designed to meet financial industry standards and support audit requirements.

Proven Track Record

We have successfully delivered lending platforms for financial institutions, fintech companies, and lending businesses. Our solutions are in production, processing loans and managing portfolios reliably.

Contact us today for a free consultation

Free Lending Platform Consultation

Why Frappe Lending is the Superior Choice for Your Operations

When evaluating lending software, you are often faced with a choice between rigid, expensive proprietary systems and lightweight tools that lack depth. Frappe Lending, a premier Open Source Loan Software, provides a powerful and flexible alternative that puts you in control.

Complete Ownership with Open Source

Frappe Lending is 100% open-source, which means you are free from vendor lock-in and costly recurring license fees. You have full access to the source code, allowing for unlimited Frappe Loan Customization to match your unique credit products and operational workflows. This makes it the Best Open Source Loan Management System for Businesses looking for a long-term, scalable solution.

Native Integration with ERPNext Accounting

One of the most powerful features of the ERPNext Lending Module is its native connection to the ERPNext accounting system. Every loan disbursement, repayment, and fee collection is automatically recorded in your general ledger. This direct integration eliminates the need for manual reconciliations, ensures financial accuracy, and provides an instant, real-time view of your portfolio's performance.

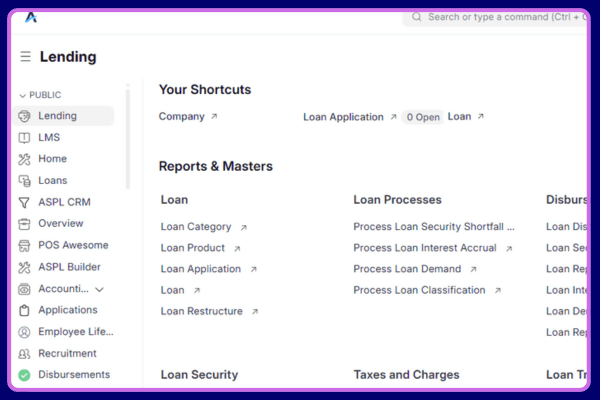

A Complete Loan Lifecycle Management Tool

The Frappe Loan App is designed to manage every stage of the lending process within a single application. It handles loan applications, underwriting and approval, disbursement, automated EMI & Repayment Scheduling in Frappe Lending, and collections tracking. This unified approach streamlines operations and provides complete visibility. We help our cutomer to customize this process according to Fintech Complience

Unmatched Flexibility and Scalability

Whether you are a startup fintech, a credit union, or an enterprise offering internal employee loans, Frappe Lending can be adapted to your needs. Its flexible data models allow you to create and manage any type of loan product, from simple personal loans to complex commercial credit lines. The platform scales effortlessly as your borrower base and loan portfolio grow. We help more to add flexibility based on requirements.

Our Frappe Lending Platform Development Services

We offer a full suite of services for the design, development, implementation, and maintenance of your lending operations platform. We provide end-to-end Frappe Lending App Customization Services to ensure every aspect of the system works for you.

Core Frappe Lending Development Services

Frappe Lending App Installation & Configuration

Our service begins with the secure installation and setup of the Frappe Lending application. We configure the foundational elements, including company details, chart of accounts integration, and basic system settings, to prepare the platform for customization and data entry.

ERPNext Lending & Loan Management Module Customization

We modify the standard ERPNext Lending Module to fit your exact operational needs. This can include adding custom fields to the loan application, creating unique status workflows, or altering the logic for interest calculations to match your specific requirements.

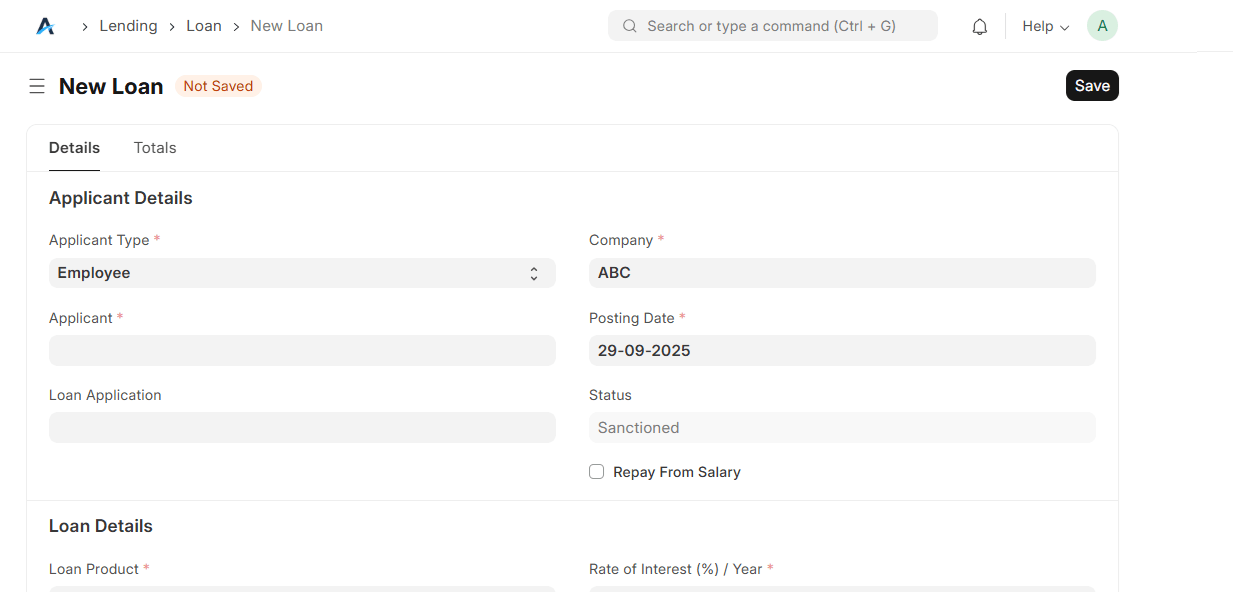

Loan Application Processing Workflow Development

We design and implement a digital, end-to-end workflow for loan applications. This includes creating public web forms for applications, defining document checklists, and setting up the internal stages for review, from initial submission to final decisioning, enabling Custom Loan Workflow Development in ERPNext.

Loan Approval & Disbursement Automation

We help you accelerate your decision-making with Loan Approval Automation with ERPNext. We build multi-level approval workflows that route applications to the correct personnel based on loan amount, risk score, or other criteria. We also automate the creation of disbursement entries upon final approval.

EMI Calculation & Repayment Scheduling in Frappe Lending

Our team configures and customizes the loan repayment module to handle your specific EMI schemes. We ensure the system accurately calculates principal and interest components for any loan product and generates a clear repayment schedule for the entire loan term.

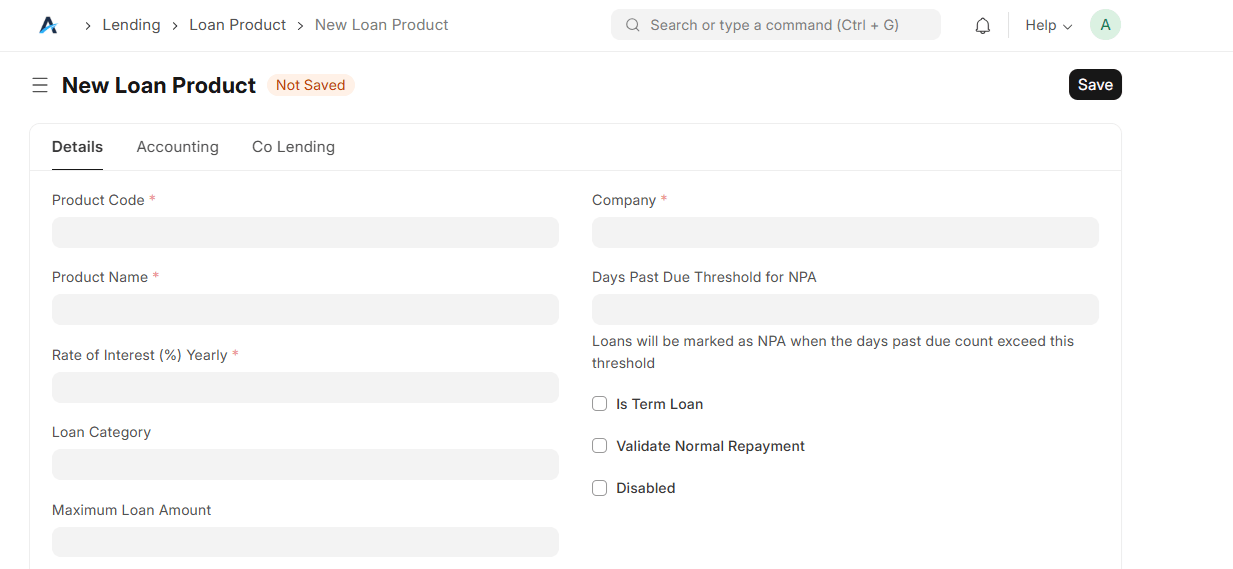

Custom Loan Product & Interest Rate Setup

We help you define all your lending products within the system. This includes setting up parameters for different loan types, configuring fixed or floating interest rates, defining fee structures (e.g., processing fees, late payment penalties), and establishing loan terms.

Become an expert in fintech on the Frappe framework

Let's Talk

Advanced Lending Platform Services

Comprehensive solutions for modern financial institutions

Integration with Accounting & Payment Gateways

We ensure your lending operations are perfectly synchronized with your finances. We manage the deep integration with the ERPNext accounting module and develop connections to payment gateways for automating both loan disbursements and EMI collections directly from borrower bank accounts. This creates a powerful Frappe Loan Management App with Payment Gateway Integration.

Credit Scoring & Risk Assessment Module Development

To improve your underwriting process, we can develop a custom credit scoring module. This system can be configured to automatically calculate a risk score for each applicant based on predefined parameters, such as their financial history, income level, and other custom data points. We help to integrate third-party APIs for the real-time updates for credit score and more.

Borrower & Lender Portal Development

We build secure, self-service web portals for your borrowers. Through this portal, applicants can track their loan status, view their repayment schedule, make payments, and download statements. This improves the customer experience and reduces the support load on your team. We help to design cross-plarform mobile apps development for iOS, and Android which is integrated with this platform.

Document Management & KYC Verification Integration

We integrate robust document management capabilities to handle all required paperwork digitally. We can also connect the platform to third-party APIs for automated KYC (Know Your Customer) and identity verification, streamlining your onboarding process and enhancing compliance.

Automated Loan Reminders & Notifications (SMS, Email, WhatsApp)

We set up an automated communication system to reduce delinquencies. The system can be configured to send automatic reminders for upcoming EMI payments and notifications for overdue payments via multiple channels like SMS, email, and WhatsApp. We integrate AI Models for Automation and more.

Multi-Branch Loan Management Setup

No matter you run with single branch or multi-branch or If you are operating business in multiple regions, For organizations with multiple physical locations, we configure the Frappe Lending platform to manage operations on a per-branch basis. This allows you to segregate loan portfolios, user permissions, and reporting by branch while maintaining centralized.

Reporting & Analytics Dashboards for Lending Operations

We build custom dashboards that give you a real-time, visual overview of your entire lending portfolio. Track key metrics such as total disbursed amount, outstanding principal, portfolio at risk (PAR), and collection rates to make informed, data-driven decisions.

Regulatory Compliance & Audit Reporting Features

We understand the importance of compliance in the lending industry. We develop custom reports and system features designed to meet regulatory requirements and simplify the process of internal and external audits, ensuring your operations remain transparent and compliant.

Migration from Legacy Lending Platform to Frappe Lending App

If you are currently using an outdated system or a collection of spreadsheets, our team can manage a smooth migration. We carefully plan and execute the transfer of your existing loan data, borrower information, and repayment histories into your new Frappe Lending App.

Mobile App Integration for Loan Application & Tracking

To meet the needs of modern borrowers, we can integrate your Frappe Lending backend with a customer-facing mobile application. This allows users to apply for loans, upload documents, track their status, and manage their accounts directly from their smartphones.

Ongoing Support & Maintenance for Frappe Lending App

Our commitment to your success continues long after the initial launch. We offer dedicated support and maintenance plans to keep your Frappe Lending platform secure, updated, and performing optimally, ensuring the long-term reliability of your core business system.

Building Your Lending Ecosystem Core Components We Develop

A successful lending operation is more than just a single piece of software; it's an ecosystem of tools for borrowers, loan officers, and administrators. We build all the interconnected components.

The Borrower Experience Application and Self-Service

Public-Facing Application Forms- Easy-to-use web forms that allow applicants to apply for loans and upload documents without assistance.

Secure Borrower Portal- A login-protected area where borrowers can check their application status, view their EMI schedule, make online payments, and download their loan statements.

Mobile-First Access- Ensuring the application and portal are fully functional and easy to use on any mobile device.

The Loan Officer's Control Center

Loan Application Queue- A centralized dashboard showing all incoming loan applications, their current status, and which team member is assigned.

Underwriting Workbench- A screen providing a 360-degree view of an applicant, including their submitted documents, credit score, and financial details, to support decision-making.

Automated Communication Triggers- Tools to send templated emails or SMS messages to applicants at key stages of the process.

The Administrator's Oversight Panel

Portfolio Health Dashboards- Visual reports tracking key metrics like Non-Performing Loans (NPLs), Portfolio at Risk (PAR), and collection efficiency.

Compliance & Audit Tools- Features for generating regulatory reports and providing auditors with read-only access to necessary data.

System Configuration Controls- Interfaces for managing user roles and permissions, creating new loan products, and adjusting system-wide settings.